Why ESG Reporting Fails and How to Turn Compliance into Competitive Edge

- lilianadomingues4

- Sep 27, 2025

- 4 min read

From Check-the-Box Compliance to Value Creation and Resilient Growth. By Liliana Domingues

Executive Summary

Companies are facing mounting pressure from regulators, investors, and customers to deliver credible ESG (Environmental, Social, and Governance) performance. However, despite widespread adoption of ESG reporting, many organizations, particularly SMEs, struggle to translate compliance into tangible business value.

At AMARNA Vida, we’ve identified a recurring pattern: ESG reporting often fails because it’s siloed, incomplete, or disconnected from financial strategy. So, we address this problem, by integrating ESG insights into financial decision-making to transform compliance into a competitive advantage.

The ESG Reporting Paradox

Despite the proliferation of reporting frameworks (CSRD/ESRS in the EU, GRI standards, TCFD guidance) recent research shows that ESG reporting is still largely ineffective in creating measurable business outcomes:

Only 32% of companies in the EU report ESG data that investors consider reliable or actionable (Eumedion, 2024).

A survey of 120 Irish SMEs revealed that 68% struggle to connect ESG initiatives to financial performance, leading to reports that satisfy regulators but fail to inform strategic decisions (SustainabilityWorks, 2023).

Global ESG misreporting or “greenwashing” risks are estimated to cost companies up to 5–7% of market valuation in investor trust erosion (Harvard Business Review, 2022).

The primary drivers of failure include:

Fragmented ESG-Financial Reporting – ESG teams operate separately from finance, producing outputs that do not feed into budgets, forecasts, or risk analysis.

Lack of Materiality Focus – Companies often report on a wide array of ESG metrics without distinguishing those that truly impact business performance or stakeholder value.

Inconsistent Data & Governance – Manual collection, disparate systems, and insufficient internal controls compromise reliability.

Compliance-First Mindset – Reporting is treated as a regulatory checkbox rather than a strategic lever for growth.

For CEOs and CFOs, this creates a dangerous paradox: regulatory compliance is mandatory, but it often fails to generate competitive differentiation or financial value.

Current State | Common Pitfalls | AMARNA Vida's Solution |

ESG & Finance siloed | Poor decision-making and fragmented data | Unified ESG-finance dashboards |

Compliance-first | Checkbox reporting and low ROI | Strategic insights driving growth |

Inconsistent KPIs | Greenwashing risk, investor mistrust | Auditable and transparent reporting |

Broad but non-material data | Effort without impact | Double materiality prioritization |

Turning Compliance into Competitive Advantage: Lessons from Irish SMEs

ESG reporting becomes a strategic asset only when it is integrated with financial performance, operational planning, and investor communication. Consider some practical examples:

Kingspan Group (Ireland): By linking energy efficiency investments to operating cost reductions and revenue growth, Kingspan demonstrates how ESG performance directly influences financial metrics. Their integrated reporting approach has contributed to a 17% higher market valuation relative to peers (AtlasMetrics.io, 2023).

Glanbia plc: Through robust ESG disclosure aligned with CSRD pilots, Glanbia improved stakeholder trust and attracted €150M in sustainable financing, demonstrating that transparent ESG-financial integration can unlock capital access (SEAI, 2023).

Smaller Irish Manufacturing SMEs: Pilot diagnostics conducted by AMARNA Vida in 2024 showed that SMEs implementing double materiality frameworks saw 15–20% improvement in operational efficiency, from energy savings and reduced waste, while simultaneously creating narratives attractive to investors.

The key takeaway: ESG is not just about reporting, it’s about actionable insight. Companies that embed ESG into financial planning and strategic decision-making can:

Reduce risk and operational costs

Improve investor and stakeholder confidence

Unlock funding and market opportunities

Enhance reputation and brand differentiation

Bridging ESG and Financial Strategy

AMARNA Vida has developed a comprehensive ESG–financial integration service designed for SMEs and mid-sized companies seeking credible impact and investor-ready reporting. It combines technical rigor, double materiality assessment, and integrated reporting to ensure ESG compliance drives growth, not just documentation.

How We Solve ESG Reporting Challenges:

Technical Rigor in ESG-Financial Integration

Aligning ESG metrics with CSRD/ESRS compliance standards.

Providing transparent, auditable reporting processes.

Delivering a Sustainability-Linked Financial Dashboard connecting ESG data to P&L and risk scenarios.

Double Materiality Prioritization

Focusing on ESG issues that drive both financial performance and stakeholder value.

Providing a customized double materiality matrix, helping leadership allocate resources strategically.

Actionable Strategic Insights

Converting regulatory obligations into decision-making tools.

Providing Risk & Opportunity Maps, scenario analysis, and actionable KPIs tied to both ESG and financial outcomes.

Investor-Ready Reporting & Communication

Crafting integrated narratives linking purpose, performance, and profit.

Strengthening credibility with investors, boards, and strategic partners.

Operational Embedment

Embedding ESG into corporate governance, budgeting, and decision-making processes.

Building capacity in leadership and finance teams to maintain integrated reporting autonomously.

Practical Outcomes:

Companies using our services can achieve measurable benefits:

Outcome | Evidence & Example |

Enhanced Financial Performance | SMEs with integrated ESG frameworks report 3–5% higher ROA and ROE (AtlasMetrics.io, 2023) |

Improved Access to Capital | Transparent ESG reporting attracts financing; Glanbia secured €150M in sustainable funds (SEAI, 2023) |

Risk Mitigation & Efficiency | Early identification of ESG risks reduces regulatory penalties; pilot SMEs achieved 15–20% operational efficiency gains (Amarna Vida, 2024) |

Stakeholder Trust & Market Position | Integrated ESG-financial disclosures improve reputation; peer benchmarking shows 10–12% higher stakeholder satisfaction scores (SustainabilityWorks, 2023) |

Why SMEs and Mid-Sized Companies Should Act Now

With the CSRD/ESRS implementation starting in 2025, Irish and EU SMEs face both regulatory pressure and strategic opportunity. Early adopters of integrated ESG-financial frameworks:

Gain competitive positioning as sustainable and investor-ready

Unlock government grants and incentives linked to ESG initiatives

Build resilient operations that can withstand market volatility

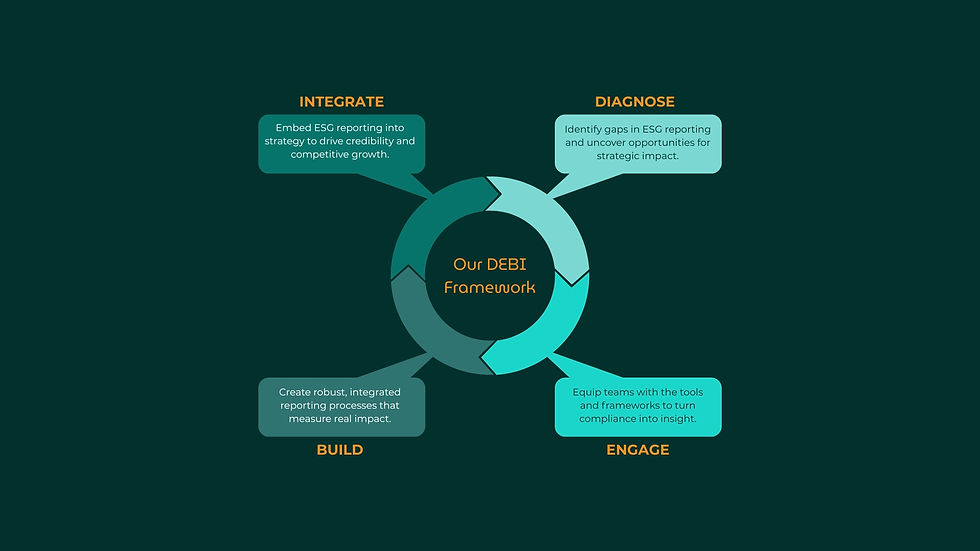

Our service provides a structured, phased approach: DEBI™ Methodology, allowing SMEs to progress at their own pace while generating tangible ROI.

SMEs integrating DEBI™ saw 15–20% efficiency gains in one year.

Conclusion: From Compliance to Confidence

ESG reporting does not have to be a bureaucratic burden. When executed with strategic intent and financial integration, ESG becomes a powerful lever for growth, resilience, and market differentiation.

AMARNA Vida’s service bridges the gap between technical compliance and strategic value creation, helping SMEs and mid-sized companies:

Meet CSRD/ESRS requirements with confidence

Translate ESG initiatives into measurable business outcomes

Communicate purpose, performance, and profit coherently to investors and stakeholders

For Irish and EU SMEs, the message is clear: don’t just report ESG. Use it to drive growth, credibility, and long-term competitive advantage.

References:

Eumedion (2024). Reliability of ESG Disclosures in EU Companies.

SustainabilityWorks (2023). ESG Challenges in Irish SMEs Survey.

AtlasMetrics.io (2023). ESG Integration Impact on SME Financial Performance.

SEAI (2023). Sustainable Financing Case Studies: Glanbia & Kingspan.

Harvard Business Review (2022). The Costs of Greenwashing for Public Companies.

Comments